The Second Depression

As some of your may know, I like to talk about life in general, not only fitness. In the end, what good is fitness if you are not happy in all other areas in your life. Financially, spiritually, physically, and also in our relationships with family and friends. I wanted to take the time this morning because I woke up and really thought that I should write a little article about the financial state of the economy and how it effects you and your family. Not only that, but if you don’t do something about it now, you could be left with absolutely nothing, no matter how much money you have.

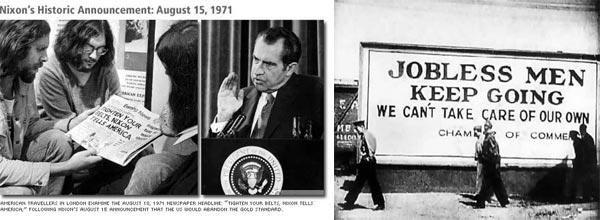

The baby boomers now are retiring and experiencing the first financial bust they have ever witnessed. They were born into years where our economy has always been on the rise after the Great Depression. The truth is, our economy never fully recovered from the first great depression and all the baby boomers know is the massive economic boom that began in 1971.

You see, our US dollar if you think about it is just a short decision away from having no value. It is the standard currency around the world right now but can you imagine if the other countries like China, Japan, Australia, and all decide to turn to another currency instead of ours? America would be done. Why? The US dollar is not backed by anything but the good faith and credit of the US government. It used to be linked to gold and silver, but in 1971, president Richard Nixon took the money off the gold standard and changed the rules of money forever. Our money became monopoly money and we started playing by monopoly rules in real life.

Bank Never Goes Broke | The Second Depression

“The Bank Never Goes Broke” One of the rules in the game, Monopoly. You see, it says that if the bank runs out of money to give out, it can just write money on a piece of paper and disperse it. That will count as real money. You want to know something scary? This is real. The bank in real life never goes broke because of the fact that they can just print on paper anytime they feel like it.

By the federal reserve being able to print money whenever they can, it puts our economy into higher debt and inflation occurs. Bailouts, stimulus plans and such, just add to $600 trillion plus that our US economy is in debt today because of the mistakes and bad decisions our nation has encountered. In result, us the taxpayers, must pay money back to the government for their own mistakes in the form of debt, inflation, retirement, and taxes. It doesn’t sound like a fair formula. However, because the system makes it so confusing for the consumers to understand, the consumers just go along with depending on the government for bailouts and financial help not understanding how it will effects their family in the future.

So, big things can happen on the instant if other countries decide they don’t want to use our money as the standard currency. It would put the US under and no matter how much money you have you will have lost everything for the future of your family. Put it easy to understand……

….If your house got broken into while hyperinflation happened, or from other countries deciding to take their money off the US standard, and the US currency lost it’s value while the Federal Reserve keeps printing money, then you would see the robbers that broke into your house steal your refrigerator and leave the pile of $100 dollar bills you left on your counter. Why? We would be going back to a world of barter and trade rather than fast currency transactions. Money would have little value.

So how can you protect your family for the worst to come if this ever happens. Trust me, it could happen real soon. According to many successful entrepreneurs I consult with on a daily basis about our economy, they are telling me to embrace myself for what is to come and educate yourself on how you can prepare your kids for the next great depression.

My question is to them, how can people prepare if they are struggling to find a job or don’t have a good enough source of income where they can put aside money and invest in the right things? Here is what they are telling me and you can bet, I am following their advice:

1) They need to get educated on why we are in this situation

2) Must study the trends of money and the economy and understand it

3) Educate themselves on what to invest their money in just in case the US dollar goes under

4) Take action

State Of Our Economy | The Second Depression

Lastly, the Federal Reserve isn’t slowing down in printing money. In March 18th, 2009, they injected 1.2 trillion dollars back into the us economy. As Robert Kiyosaki stated in his book, Rich Dad’s Conspiracy of the Rich:

“In a normal economy, when the US Treasury offers bonds, countries such as China, Japan, England, and private investors buy the bonds. But, when the Fed buys are bonds, this means the US is truly printing money. This means that our economy is still collapsing like a hot-air balloon with a tear in it.